In the aftermath of California’s devastating wildfires, a handful of politicians suggested that any federal relief for the state should come with strict conditions. This stance might have seemed little more than routine political hardball—until one considers the underlying irony: many of these very politicians hail from states that receive far more federal funds than they contribute, a reality often swept under the rug during budget debates.

By contrast, California consistently sends billions more to the U.S. Treasury than it gets back in federal spending. According to the most recent available data from the Rockefeller Institute of Government and other budgetary analyses, California contributes tens of billions of dollars above what it receives (some estimates put this “net contribution” north of $80 billion a year). If California were an independent country, it would rank among the top economies on the planet—recent figures suggest it is either the world’s fourth- or fifth-largest economy, depending on the metrics used.

Yet despite this clear imbalance, some states that do not pay their own way—sometimes dubbed “net recipient” or “taker” states—seem particularly inclined to cast stones. It’s not merely a paradox; it’s a reminder that much of America’s financial framework is rooted in outdated assumptions about how federal power, state responsibilities, and national representation ought to function.

The Hidden Subsidies of “Taker” States

Discussions about the federal budget frequently revolve around states like California, New York, Massachusetts, and New Jersey being labeled “tax heavy” or “elitist.” Less talked about is how these same states effectively subsidize the budgets of other states through federal transfers—programs like agricultural subsidies, military bases, and various forms of federal assistance. States with relatively smaller economies and populations often receive significantly more in federal outlays than they contribute in federal tax revenue.

For instance, Kentucky, Mississippi, West Virginia, and Alabama are often cited in government data as among the top net recipients on a per-capita basis. Meanwhile, on the opposite side of the ledger, large urbanized states—though not without their own challenges—tend to pay in more. The political conversation becomes fraught when net recipient states insist on austerity measures or ideological strings for states dealing with climate disasters, while continuing to reap disproportionate fiscal benefits from the national purse.

The Problem With Outdated Structures

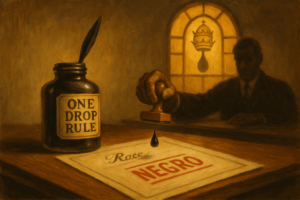

Underlying these financial imbalances are constitutional structures, such as the Electoral College, that date back to an era when the United States was a collection of agrarian colonies. The intent—ensuring smaller states and slaveholding states had a say—may have been politically pragmatic centuries ago, but it has grown progressively untenable in the 21st century.

- The Senate: Each state, regardless of population, elects two senators. That means a state with fewer than a million residents has the same senatorial clout as California, with nearly 40 million people. In practice, this dilutes the political power of the majority of American citizens—often those who are the primary contributors to the national tax base.

- The Electoral College: The winner-take-all system in most states, coupled with a structural advantage favoring smaller states, can skew presidential elections in ways that do not necessarily reflect the national popular will—or the economic power that some states bring to the table.

While tradition deserves a certain respect, clinging to arrangements forged in the late 18th century risks hobbling American competitiveness in the 21st. A system that perpetually rewards states that do not generate sufficient economic vitality ultimately threatens to hold back the nation as a whole.

The New Imperative: Competitiveness

In an era dominated by rapid technological advances—particularly in artificial intelligence, robotics, and renewable energy—having a well-educated workforce, robust infrastructure, and a forward-looking outlook is essential for national success. States leading in these areas, such as California, Washington, Massachusetts, and others, are poised to thrive in a knowledge-based, globalized economy.

Meanwhile, states that have struggled to fund their educational systems or modernize their industries risk falling even further behind as automation and AI replace many low-skilled jobs. If these lagging states wield disproportionate veto power—via the Senate, the Electoral College, or other structural advantages—it not only undermines more dynamic states’ efforts at progress, but also weakens the country’s capacity to keep pace with fast-moving global competitors like China, the European Union, and other emerging blocs.

Rethinking Federalism for the 21st Century

No one is suggesting we abandon the concept of federalism or punish less prosperous states into oblivion. Solidarity—particularly in a federal republic—is important. Disasters such as floods in the Midwest, hurricanes in the Gulf, or wildfires in the West demand a unified national response. But solidarity should be tempered with realism, fairness, and a drive toward systemic reform.

- Modernize Representation:

- Reform the Electoral College. Whether through the National Popular Vote Interstate Compact or a constitutional amendment, America’s presidential election system should better reflect the principle of “one person, one vote.”

- Reevaluate the Senate’s Role. While eliminating the Senate’s equality of representation is a tall order, acknowledging its distortionary effects—and seeking ways to mitigate them—would be a step forward.

- Incentivize Economic Self-Sufficiency:

- Targeted Federal Investment. Federal dollars should support workforce retraining, STEM education, and green infrastructure in underperforming regions, not just prop up outdated industries. The end goal should be uplifting these states so they can join the ranks of net contributors.

- Accountability Measures. If certain states remain chronically dependent, it raises a conversation about fiscal responsibility and local governance. Federal aid should come with a roadmap for improvement, not just a blank check.

- Empower States Driving Innovation:

- Federal-Local Partnerships. States showing leadership in AI, biotech, clean energy, and high-tech manufacturing ought to receive robust federal support. Encouraging further growth in these sectors will bolster the national economy—and generate the tax revenue needed to support struggling areas.

- Infrastructure Modernization. Investing in ports, roads, broadband, and public transit in economically vital regions can ripple throughout the broader national economy.

Toward a Cohesive, Competitive America

The conversation is no longer about simply “making America great again” by looking to the past. Instead, we must focus on how to “make America competitive again”—and keep it that way in an era of accelerated global change. We do ourselves no favors by clinging to vestigial policies from centuries past that give undue power to those areas of the country unwilling or unable to invest in the fundamentals of modern success.

Yes, a vibrant democracy needs input from every corner of the union. But failing to address the glaring economic and political inequities in our system risks hobbling the states that are already at the forefront of the 21st-century knowledge economy—and dragging down the nation’s overall ability to thrive.

If we are serious about the American experiment, we should design it for the world as it is now, not as it was in the 18th century. Doing so means incentivizing a competitive, innovative spirit across all states, providing meaningful support for those that lag behind, and ensuring that national policymaking reflects the realities of population, contribution, and potential. Only then can we move beyond rhetorical slogans and invest in a future where America’s best days truly do lie ahead.

Add your first comment to this post